Transitioning towards sustainable investing

By Dirk Schoenmaker

We stand on the brink of a great transition that is potentially planet-changing, at the end of which the societal and environmental impact of corporate projects will take over from their mooted financial return as the main driving force behind future investment.

I see two main trends. One, because of general news coverage and academic influence, general acknowledgement would seem to be growing that sustainability should be regarded as an issue in the financial world. Accompanying this is an increasing awareness that sustainable investment is in itself a good thing. Two, the time is coming for sustainability to be integrated into the investment decision-making process, alongside or even ahead of the traditional focus on financial returns. Financial returns will, of course, remain a consideration, but they should not be the only factor in the investment equation. Social value is equally important. Even more so, for those, like myself, who believe that time is running out to effect real positive change that will benefit society, humanity, and of course the planet.

Dirk Schoenmaker

is Professor of Banking and Finance at Rotterdam School of Management, Erasmus University.

His research and teaching focus on the areas of sustainable finance, central banking and financial stability, financial system architecture and European financial integration. He earned his PhD in economics at the London School of Economics, is a non-Resident Fellow at the Brussels-based think tank Bruegel and a Research Fellow at the Centre for European Policy Research (CEPR).

Also interesting for you

“…companies that have been talking the social, environmental and governance talk for some time are now actually starting to translate that talk into undeniable action.”

Preparation and prevention

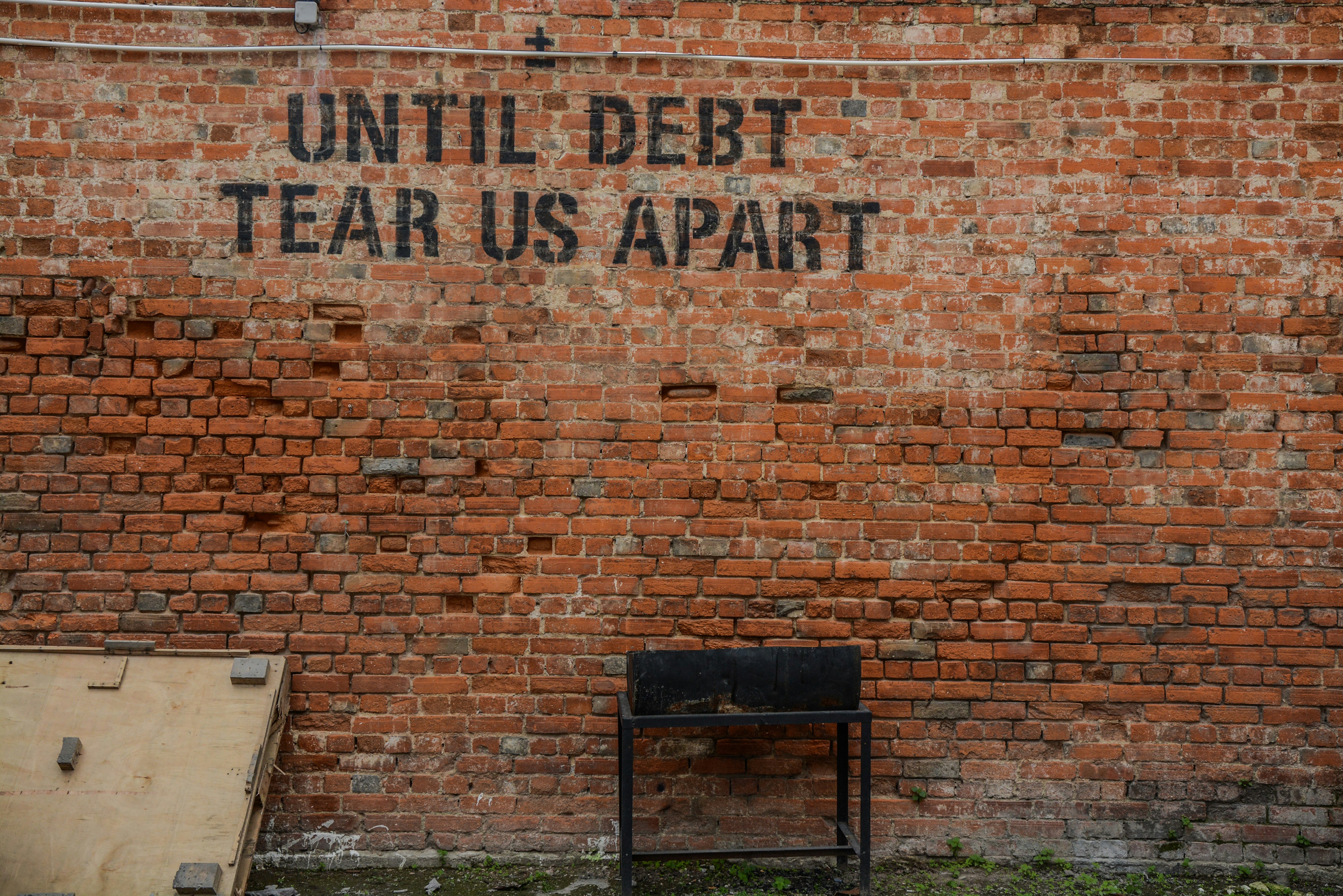

If we are to avoid reaching a tipping point in the next decade or so from which it would be extremely difficult to return, we need to prepare for the future, to prevent trends from reverting to simple short-lived fads, beginning now. Companies that do not take appropriate action will over time begin to lose their social licence to operate, in everyday practical terms if not in top-down government and regulatory terms. Anecdotal evidence is strong that in a world where the elimination of carbon emissions is attaining the status of a religious belief and a moral duty, university students who have grown up caring less about earning top dollar than doing what they believe to be right, are rejecting industries like oil and gas, and tobacco, as post-graduation employment options. If the brightest in their generation have indeed begun to rule out working in those sectors, the writing is very much on the wall.

Other sectors have attracted adverse publicity too. Companies that outsource the manufacturing of clothing to low-cost locations are coming under mounting pressure to pay a living wage appropriate to the country or countries involved and ensure safe and comfortable working conditions. Legislation to this effect is currently under consideration in the Netherlands but I believe that responsible companies should act in advance of legislation rather than follow it reluctantly only once it is in force. Construction companies could also review their modus operandi. As my colleague Frank Wijen points out elsewhere in these columns, wood could be used more in the building of houses, perhaps even offices, reducing the need for carbon emission-intensive cement and concrete. A clear opportunity exists for building companies to steal a march on their competitors.

Positive signs

There are a growing number of examples in the real everyday world that give me confidence that in at least some quarters the matter is being examined through a new lens. I see indications that companies that have been talking the social, environmental and governance talk for some time are now actually starting to translate that talk into undeniable action. Returning to oil and gas, major French bank Societe Generale announced in late October that it would be embarking on a new stage in its climate strategy to align all its activities with the objectives of limiting global warming as defined by the Paris Agreement. It says that over the coming months, it will set itself precise sector-by-sector alignment targets for each of its financing portfolios, starting with the most carbon-intensive sectors.

After engaging in a process to completely exit the coal sector by 2030 for EU and OECD countries and by 2040 for the rest of the world, Societe Generale has taken another significant step forward. It has announced a concrete (no pun intended) short-term target to reduce its overall exposure to oil and gas extraction by 10 per cent by 2025 and has decided to stop financing onshore oil and gas extraction in the US. For some, UK-listed global energy giant BP provides an excellent example of preparation for transition, in that Bernard Looney, who became the company’s CEO in February 2020, taking over from Bob Dudley, has been making positive noises about decarbonising the company.

In the formal notes on the BP website welcoming him to the role, he says: “We know the world is not on a sustainable path. We want a rapid transition. Society has to deliver the Paris goals.” BP does, however, have something of a credibility problem in this area, as it has been making similar noises for quite some time, dating back to the campaign that saw it change its name to Beyond Petroleum in 2000. A lot has been promised, but little has so far happened, as is evidenced by the company’s capital expenditure, which is still largely geared towards fossil fuels. We are yet to see a switch in its investment plans from the traditional areas of oil and gas exploration towards investment in renewables.

This is a key metric that will tell the world whether BP is putting its money where its mouth is. For the time being, at least it is indicating awareness of the issue and the role it can play in addressing it. For its part, Royal Dutch Shell, which recently confirmed it would cease its dual UK-Netherlands stock exchange listing and list solely on the London Stock Exchange, has shown that it will listen to investors. Having announced that it would launch a drilling programme in Alaska in 2015, it quietly shelved the plans on learning of the concerns being expressed by at least one major Dutch pension fund.

Also interesting for you

“We are seeing progress in the acceptance of the validity of sustainability, as a concept and in practice, but we must not overestimate the advances that have been made.”

More progress required

Issues are clearly on the table that would once have been laughed at, and discussions would seem to be taking place behind closed doors, in what once would have been almost certainly smoke-filled rooms but are now, of course, smoke-free rooms. But, at the risk of sounding impossibly clichéd, there is no room for complacency. We are seeing progress in the acceptance of the validity of sustainability, as a concept and in practice, but we must not overestimate the advances that have been made. It is still very early days; real impact on a larger scale is not recorded yet.

To conclude on a relatively simple note, commercial projects by definition will not be undertaken if the estimated financial return is negative. What might happen if it becomes ingrained to apply that same hard logic to projects that are societally negative? If major pension funds and other international institutional investors adopt such an approach, there is no telling what might happen. One thing is certain, we cannot echo the behaviour of Roman Emperor Nero and carry on metaphorically fiddling while Greenland and Antarctica melt.

Steve Kennedy focuses on the importance of tackling grand challenges systematically using resilience

Rob van Tulder posits that the SDGs can provide a framework for improving our response to the next crisis